Understanding Vehicle Hire Excess Insurance: What You Need to Know

Introduction: Let’s face it-insurance can be confusing. And when it comes to rental vehicles, the terms “liabilities” and “excess” often leave people scratching their heads. This blog aims to clear up the confusion so you know exactly what you’re signing up for when hiring a vehicle.

What is Excess Insurance? When we talk about excess insurance, we’re referring to the amount you’re liable to pay if something goes wrong with a rental vehicle. Most of the time, this means physical damage to the vehicle. But if you’re negligent and cause mechanical issues, you could also be on the hook for repairs.

The term “excess” refers to the dollar amount you pay in the event of a claim. Different companies have different excess options, so it’s essential to understand what you’re agreeing to.

What Do We Mean by Excess Insurance? Let’s break it down:

- Excess: This is the portion you pay out-of-pocket when making an insurance claim.

- Insurance: This is the broader policy held by the rental company, not you.

Here’s the key point: rental companies aren’t selling you insurance. They’re offering reduced liability options. You’re paying the rental company, not an insurance provider. They then make the claim on your behalf. Many companies offer an “excess reduction” to lower the amount you’re liable for on their insurance plan.

Why Do You Have to Pay an Excess with Insurance? Much like your personal car or home insurance, vehicle hire insurance comes with an excess. The insurance policy is in the name of the rental company, so if they need to make a claim, they pay the excess-and pass that cost onto you. Even if you’re “fully covered,” you’re still responsible for that excess unless you’ve chosen to reduce it.

Often, if you’ve selected a lower excess rate, the rental company is absorbing more risk. Their actual excess might be higher than what you’re being charged.

What Are Your Liabilities in the Event of an Accident? Always read your rental agreement thoroughly. In most cases, your liability is limited to the excess amount stated in your contract. But there are exceptions:

- Loss of use: You might be charged for the time the vehicle is off the road.

- Negligence: Damage caused by negligence may result in full repair costs.

We’ll explain how Handy Rentals handles this in just a moment.

What to Watch Out For: Here are a few red flags to keep in mind:

- No excess reduction option: Some companies don’t offer a way to reduce your excess. Always ask what your liability will be.

- Exclusion clauses: Look out for fine print that excludes coverage for certain types of damage or locations.

- Excess charged at pickup: Some companies now charge the full excess upfront if you’re not using a credit card. Handy Rentals doesn’t do this, but it’s something to be aware of.

Bottom line? Ask questions and read before you sign.

How Handy Rentals Handles It: At Handy Rentals, we aim to keep things transparent and straightforward. Before every hire, we walk you through your chosen insurance option to ensure it fits your needs. Not all companies do this, but we believe it’s essential.

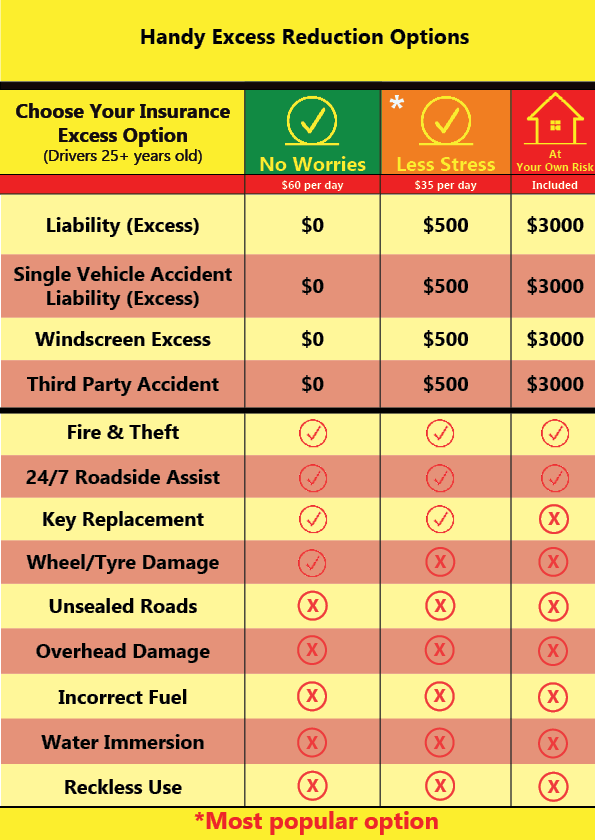

Here’s what we offer:

- Standard (Included with every hire): $3000 excess. This is the maximum you pay if the vehicle is damaged. Overhead and water immersion damage incur full repair costs.

- Reduced ($35/day): $500 excess. Same exclusions apply.

- Zero ($60/day): $0 liability for damage, excluding overhead, water immersion, and negligence.

The key takeaway? Don’t just sign-understand what you’re signing. And if you’re after a rental company with clear policies and fair rates, book your next van or truck with Handy Rentals.