Buying or Leasing, What’s Better?

Over the last few years, we’ve seen more and more businesses choosing leasing as the best option. But buying still remains an attractive solution for many reasons. As your reliable transportation partner, we’ve put together a guide of the key points to help you decide whether it is better to lease or buy commercial vehicles.

Whatever the case, businesses must consider what’s right for their unique circumstances so they can continue to thrive.

Do you Need to Buy a Commercial Vehicle?

Figuring out the best option means taking into consideration several factors. Such as, do you believe that the cost of your current transportation solution is excessive? How much capital do you have available? Do you like owning vehicles for five years or more? Or will you save money by leasing? Weigh up the pros and cons.

You’ll need to work out the total cost of ownership (TCO) over the life of the vehicle, such as registration, maintenance, fuel costs and insurance. Analyse previous running costs and speak with your accountant or finance team to work out a plan.

Are Your Vehicles Fit For Purpose?

Making sure you have the right vehicle for the job is essential. That way, you won’t waste money on vehicles which aren’t fit for purpose. An older vehicle might be cheaper and still do the job, but it may cost more in maintenance. Whereas a newer vehicle with the latest technology might cost more upfront, but cheaper running costs could save you in the long run.

Every business has different needs. These need to be factored into the final decision. Do you have vehicles that sit there without moving much? Or do they work hard and require frequent repairs? Likewise, if you plan on expanding, your fleet requirements might change soon. These are all things to consider when making an informed choice about whether you should lease or buy commercial vehicles.

Why Buy When You Can Lease?

Leasing a vehicle is essentially the same as renting, except there is usually a longer hire period. The benefit is that instead of paying for a vehicle outright, which can put enormous pressure on cash flow and involve jargon-laden agreements, leasing can provide a stress-free option where the fleet management company looks after the admin and cost of running the vehicle.

The price is all bundled up into one monthly payment. Then, once the lease agreement has finished its term, you return the vehicle.

Benefits of Leasing

Leasing can make more sense for many reasons. Here are just some of the key benefits:

- Save money by leasing

Leasing is more cost-effective in the short term. There is no need to have the upfront capital available to purchase the vehicles. And the cost to lease could work out cheaper than finance repayments per month.

- More cash flow

Leasing is a better option for businesses wanting more cash flow each month. This frees up capital for other company expenses, such as technology and scaling during peak times. The affordability of leasing means you can increase the size of your fleet as your company grows without the expense of buying.

- Drive updated vehicles

There are the inevitable issues that come with an ageing vehicle. Rather than maintaining an older fleet, with leasing, you can regularly update. This ensures you and your staff have reliable transportation with the latest safety features. And there’s no need to organise or wait for repairs.

- Save time by outsourcing

Keeping on top of servicing, fuel receipts, and all the paperwork can drain already time-poor businesses. Not having to worry about maintenance, registrations, or warrant of fitness by leasing to a fleet management company that takes care of everything saves time and effort.

- Minimise risk

Leasing avoids the hassle and risk when it comes time to purchase a new vehicle. Plus, you avoid the hassle when it comes time to dispose of it.

Leasing also minimises the risk of outlying the cost of purchasing a vehicle or fleet of vehicles when you don’t have a guaranteed long term contract.

The Downsides of Leasing

- Extra mileage fees

If you do lots of driving in your business, purchasing can work out better in the long run. Some fleet management companies charge for excessive mileage, so check your lease agreement if driving long distances is a big part of your job. - No money back at the end of the lease

You might save money by leasing but unlike buying and selling, you won’t get any money back when you have finished the lease term. That means you’ll miss out on having an investment to put toward your next vehicle purchase.

Benefits of Buying

Buying is a big commitment, but if your company has the finances to outlay the initial deposit and the cost is on par with leasing, buying might be a better choice.

The main benefits include:

- Control of the vehicle

Once you have paid off any financing, you retain the title of the vehicle. That means it’s your asset now, and you can decide when it’s time to dispose of the vehicle and how.

- Ownership allows more flexibility

Will your vehicles require custom equipment or upfitting that can drastically alter their appearance? Generally, you won’t have the option to significantly modify a leased vehicle. But when you buy, you have the flexibility to alter the vehicles to suit your needs. In this case, buying is best.

- Can work out more cost-effective

When you own a vehicle outright there are no more repayments to make. Whereas with a lease you are making repayments as long as you have the vehicle. And if you choose to resell you get to dictate the price which can net you extra cash. That’s something you won’t get with leasing.

- Business asset

A commercial vehicle can be viewed as a business asset, which can help with collateral on a loan. You also might be able to claim depreciation on your taxes.

- Less restrictions

You are responsible for your own vehicle, not the fleet management company. That means your maintenance is paid as you go, and you’re not tied to a lease agreement that might stipulate limitations to where you can take your vehicle. Buying a fleet also ensures you have vehicles available without the need to organise a lease.

The Downsides of Buying

- Drive outdated vehicles

Owning your vehicle means you will likely have it on the road longer. This leads to a higher chance of damage or the vehicles becoming outdated. Drivers won’t benefit from the latest technology like navigation, comfort and safety features. - More expensive in the short term

Outlying the initial deposit means buying is more expensive in the short term, especially if you need to acquire a fleet quickly. And if you’re paying with finance, you need to consider the interest rate on the full vehicle rather than a portion. - More to think about

With constant market fluctuations (and unforeseen damages), the future of your vehicle is uncertain. With leasing, you know what you’re getting and when you need to hand it back. So if you’re ready to trade it in after six months or two years, the options are available.

Leasing Through a Fleet Management Company

When you own a vehicle outright, you manage the analysis of your transportation data, such as inventory, invoices, costs, insurance and maintenance. If you lease, a fleet management company will support and manage your fleet. They have experience in helping you minimise your total cost of ownership so you save money by leasing.

You’ll discuss your unique requirements. This will be put together in your lease agreement that specifies the lease term, payments and return process.

There are plenty of fleet management companies around New Zealand that can help with your needs. Some are suited to large companies, while others specialise in helping small to medium businesses.

Leasing With Handy Rentals

Founded in 1989, Handy Rentals began by renting utes from Shell service stations and has since grown into supplying modern commercial vehicles. We’ve been filling the gap of excess fleet requirements for small to medium businesses around New Zealand for decades. This means we have years of expertise in solving our customers’ transportation requirements.

When you lease a Handy vehicle we will take care of:

- Warrant/Certificate of Fitness

- Servicing and maintenance

- Tyres and wheel alignments

- Vehicle registration

- Any unexpected breakdowns

Easy Logistics Management For Excess freight, New contracts or Big Jobs

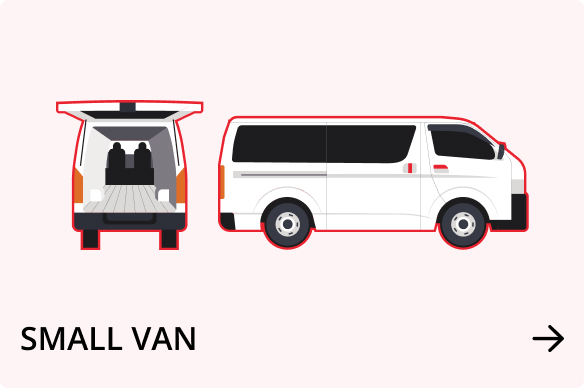

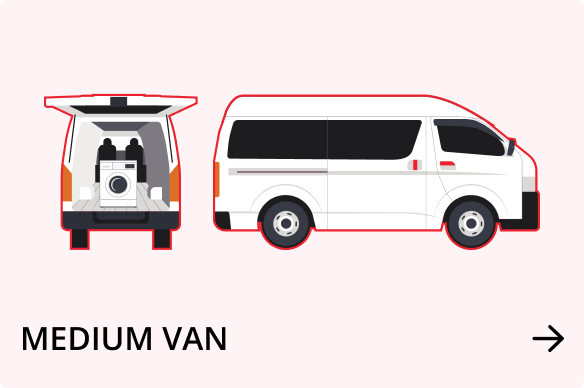

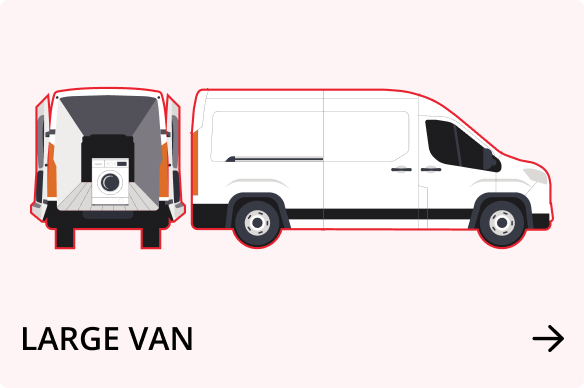

When you lease with Handy Rentals, we make sure you’ve got a reliable vehicle with up-to-date safety and technology. We’ll get to know the partnerships you have with your clients and match you with the right resources so your business continues to flow.

Leasing through Handy Rentals is always straightforward. Whatever your needs are, we will support your business with transportation that can expand alongside your business.

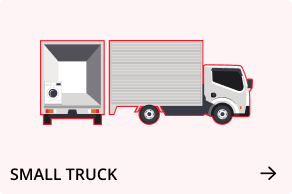

Buy Your Vehicle Through Handy Commercials

Do you need to buy a commercial vehicle? If you choose to buy, we’ve got you covered too. Handy Commercials provides quality commercial vehicles to sell. Our vehicle sales stock includes a wide range of selected fresh imported vehicles. We also have retired rental vehicles that have been regularly serviced and well-maintained. Visit the Wellington yard or check out our range of vans and trucks online.

Lease With Handy Rentals and Become a Business Account Holder

Handy Rentals Business Account holders receive special rates and services for frequent and long term van and truck rental hire, available at our eight locations across New Zealand.

Benefits include:

- Exclusive discounted rates

- 50 FREE km per day

- Dedicated Handy Account Manager

- Preferential and priority treatment

- Easy bookings for staff

- Faster pick up and drop off with 24/7 options

- 24/7 roadside assistance

- Flexible rental or lease lengths

- Unique short leases (6 month minimum)

Is It Better to Buy or Lease a Car In NZ?

There’s a lot to consider when deciding whether to lease or buy commercial vehicles. We advise you to thoroughly research the potential for keeping working capital in your company, the benefits of cash flow, and any potential tax advantages. Consider all options and decide the best option for your business.

If you’d like to learn more about leasing a vehicle with Handy Rentals, simply fill in your details in the form below and get signed up to our Business Account. An account manager will get in touch to answer your questions and see how we can help you.